Beta Week

Here’s a quick recap of beta week. I unkinked the kinks and upgraded the scanner with a snazzy new feature.

Three early users joined and put every part of the experience to the test. I spent the week shaping and reshaping the flow and format of the signals, always narrowing my focus on clarity and results.

Highlights

The one that got away

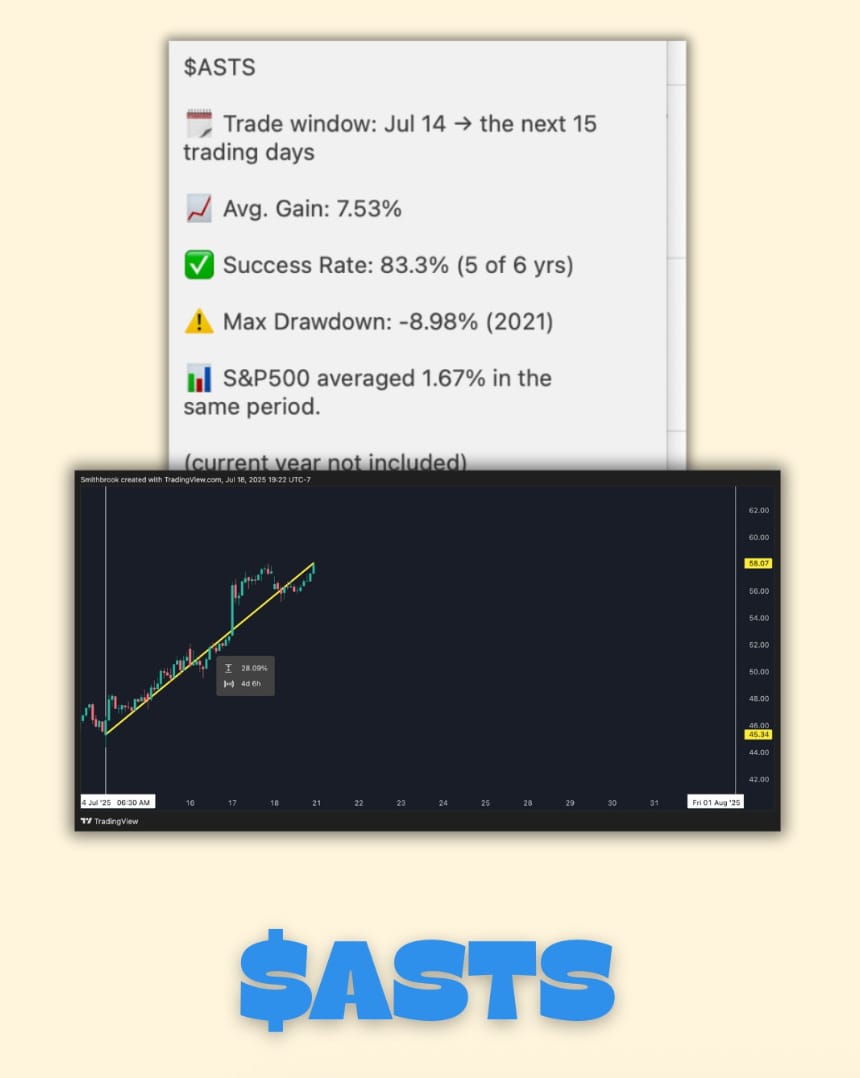

$ASTS appeared on the watchlist Monday morning with a trade window set for 7/14 through 8/1 and an expected average gain of 7.5%. Due to a script error, though, it didn’t make it to the Telegram channel.

Here’s what happened with $ASTS this week:

- From open to close: +27.9%

- From low to high: +30.85%

- From close to close: +21.18%

Obviously, $ASTS obliterated the +7.53% average gain… and we missed the entire move. And on top of that, there are (still) two more weeks of potential gains until the trade window closes. I’ve made the necessary upgrades to ensure this never happens again, but—wow. That one stings.

Gratitude

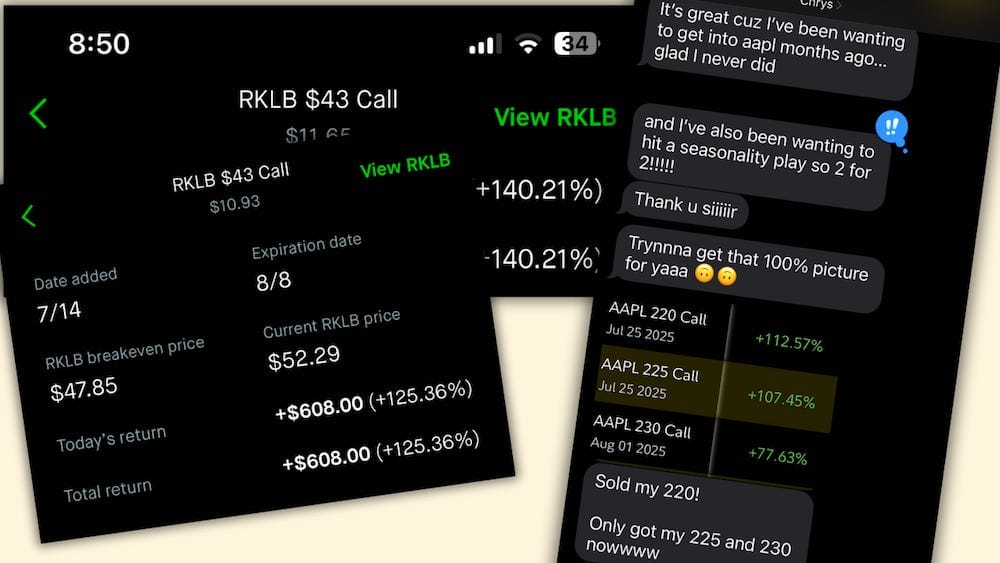

A special thanks to Chrys—a talented trader who loves charting and systems almost as much as he loves the 34EMA. This guy answered every text and provided invaluable feedback all week. Much appreciated, Chrys—see you on the inside.

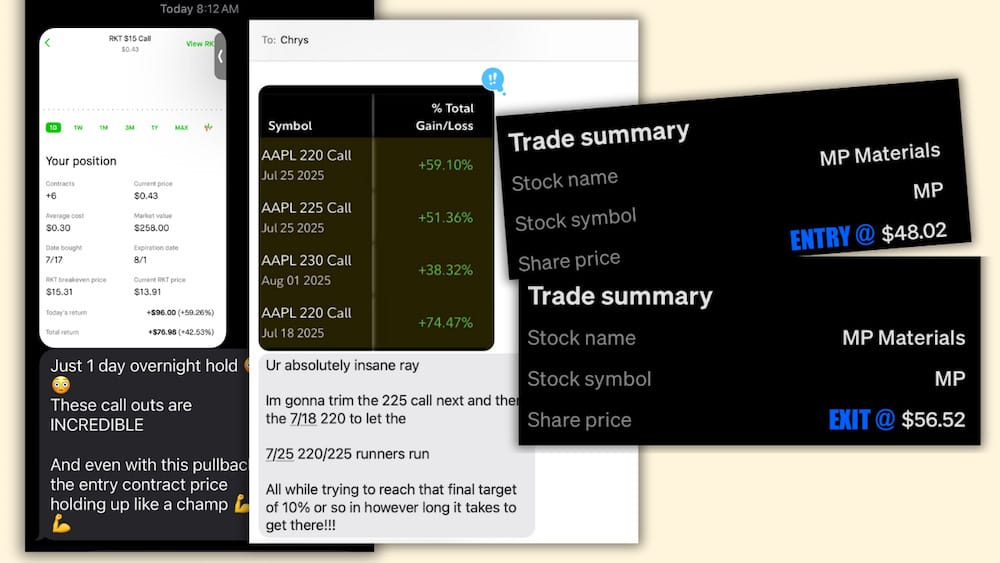

Another special thanks to Gerri and Paul—two 60-something-year-olds, new to trading, who took a leap of faith with SeasonalFlow and executed their first-ever successful trades. They had a lot of questions, and I had answers. Working with them was a trip down memory lane for me—back to 1998, when I first discovered online trading (via Scottrade) and learned the basics of order types, position size, and risk management.

Seeing Gerri and Paul navigate their first trades reminded me how important it is to keep things simple, clear, and supportive—especially for those just starting out. Their curiosity and determination are inspiring, and their success proves that it’s never too late to learn something new.

Discussion